Will My Insurance Go Up If I Use My Insurance To Fix My Car Instead Of The Other

Causing a car accident can enhance your auto insurance rates in a big way. On boilerplate, machine insurance rates get up 46% if yous cause an accident that caused an injury.

However, your rates typically won't get upwardly if y'all didn't crusade the accident or you have accident forgiveness. And not every automobile insurance company or country handles an blow on your driving record the aforementioned way.

- How much will your car insurance rates get up later an accident?

- Cheapest companies later on an accident

- When does an accident stop affecting rates?

- How to save on car insurance after an accident

How much will your automobile insurance rates increment after an accident?

If you become into an at-mistake auto accident and someone was injured, your motorcar insurance rates could become up $1,157 on boilerplate, an increase of 46%.

That rate hike is about pronounced in Michigan, where an accident more than doubles annual costs. In dissimilarity, an accident in Kansas only raised rates 8%.

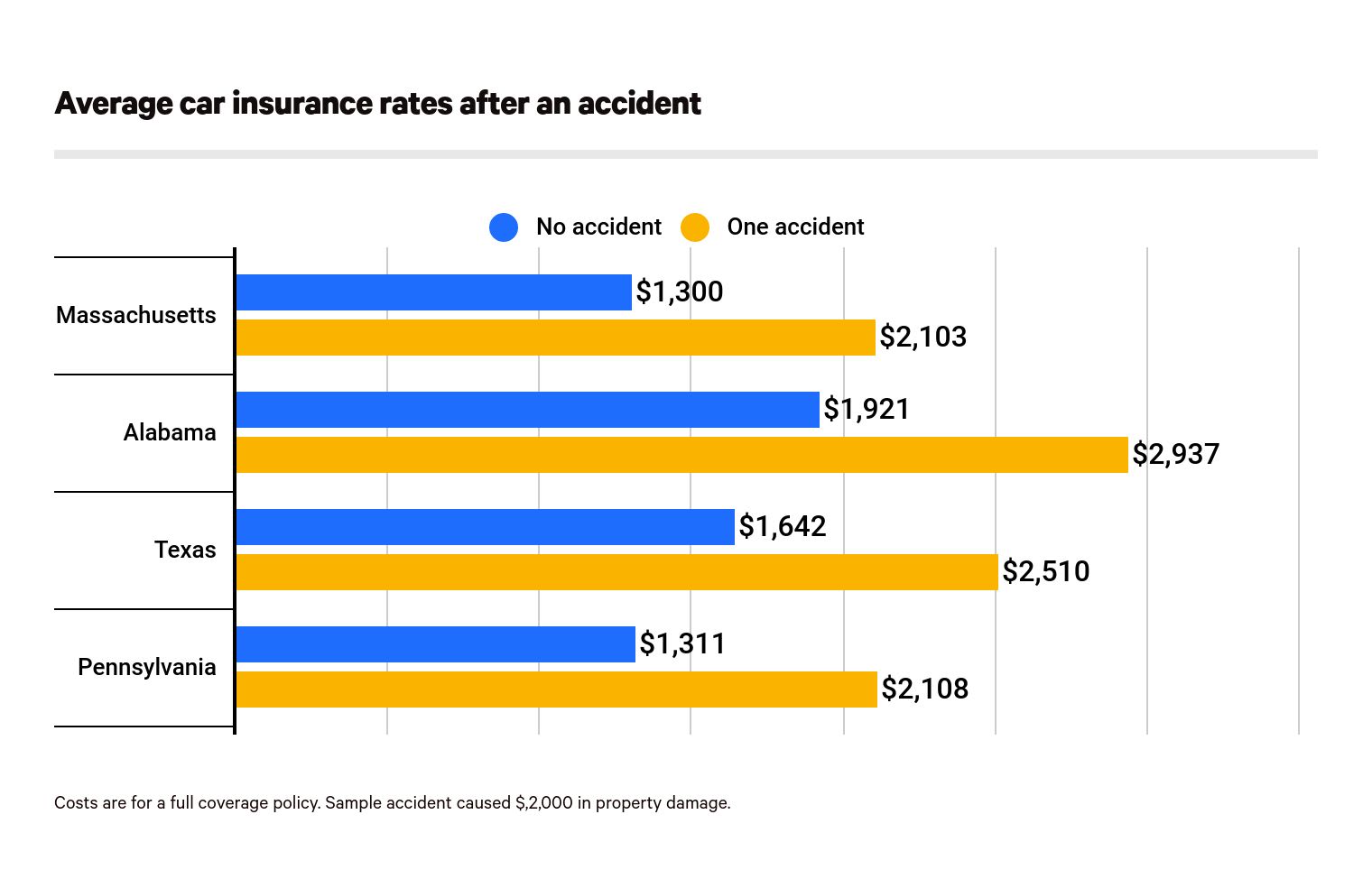

Rates increase even more when an accident involves property damage of $2,000 or more. Car insurance premiums increased 56% with an accident that causes holding damage, while rates only increased 47% in an blow with a actual injury claim.

Notice Cheap Auto Insurance Quotes After an Accident

Information technology'due south of import to note that if y'all are not found at fault for an accident, your insurance rates will likely not go upwards. Only that'south not true in all cases, as some companies raise rates slightly even if you're non at error.

After an accident, your state'due south laws and your insurer heavily influence the impact to your rates. That's why it's important to compare quotes afterwards your driving tape changes. The same commuter looking for car insurance afterward an accident might get a ameliorate deal with a dissimilar insurance company.

Which companies have the best machine insurance later an accident?

Afterward an accident, your insurance visitor volition decide how much your rates go upward. Beyond the largest automobile insurance companies, Land Farm had the smallest charge per unit increase for an at-mistake accident, only 24%. Allstate, Progressive and Geico rates for full-coverage auto insurance went upward at least 50% on boilerplate.

| Company | Annual policy cost | With accident | Increase |

|---|---|---|---|

| Land Farm | $1,623 | $ii,020 | 24% |

| USAA | $1,288 | $1,824 | 42% |

| Allstate | $3,585 | $5,488 | 53% |

| Progressive | $2,321 | $3,569 | 54% |

| Geico | $ii,017 | $three,194 | 58% |

Many companies offer accident forgiveness, which means your first accident won't cause your rates to go upwards. Usually, blow forgiveness is either an add-on that costs more or a complimentary perk offered subsequently driving for three to five or more than without getting in an accident.

Each company also sets certain thresholds on what is considered an accident when it comes to raising rates. For example, Country Farm won't raise your rates for an accident merits if the full damage is less than $750 between liability and standoff coverages. Geico and Progressive are similar, with a $500 threshold in well-nigh cases.

When does an accident end affecting my automobile insurance rates?

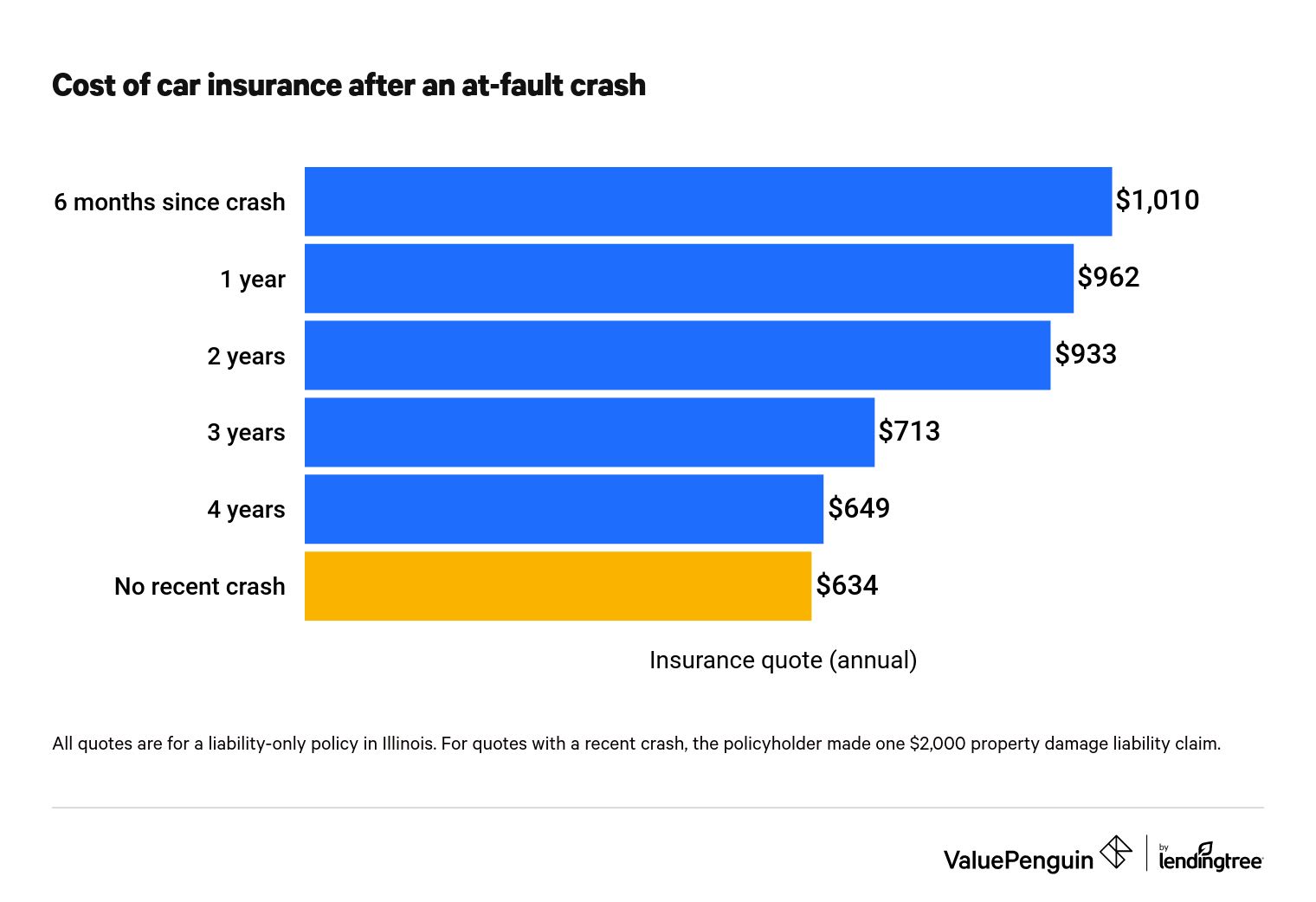

The longer ago you made a claim on your insurance, the less of an bear upon it will take on your rates. Your rates will go upward the most in your first renewal period after the crash, then return to normal after between 3 and five years.

If yous were responsible for a crash inside the last six months and made a liability claim equally a consequence, your rates will increase past about 60% the next time your policy renews. That increase volition go away gradually over time, with rates lowering to about 47% higher than normal afterward two years and only 2% higher than normal afterwards 4 years.

| Time since at-fault crash | Annual cost of insurance | Charge per unit increment |

|---|---|---|

| six months | $1,010 | 59.iv% |

| 1 year | $962 | 51.eight% |

| 2 years | $933 | 47.three% |

| 3 years | $713 | 12.6% |

| four years | $649 | 2.4% |

| No contempo crash | $634 | — |

Prices are 12-month quotes for minimum coverage in Illinois. Policyholder made an at-fault belongings damage liability merits of $2,000.

Car insurers have institute that drivers who have been responsible for a crash recently are more probable to make another claim. That's why insurers charge these drivers more than. Notwithstanding, the longer ago that incident was, the less information technology will affect your insurance rates.

When an accident might non increase car insurance rates

Defining what isn't an accident is more complicated than defining what is. But near insurance companies consider the driver'due south fault in an blow.

Some insurers check whether the policyholder is at least 50% at fault. If you don't meet this threshold, so your insurer often won't increase your rates. But there are exceptions. For example, some insurers don't follow this dominion for new customers. But proving fault in an accident can be difficult.

According to Country Farm, the policyholder isn't at mistake if they were:

- Lawfully parked

- Reimbursed past, or on behalf of, a person responsible for the accident

- Rear-ended and not convicted of a moving traffic violation in connection with the accident

- Hit by a hit-and-run driver, as long as the blow is reported to the police within 24 hours

- Not convicted of a moving traffic violation in connexion with the accident, simply the other driver is

- Reported damage caused by birds, animals or falling objects

How to save on car insurance rates after an blow

If you are at mistake in an accident and your car insurance rate increased, you can still find means to reduce your car insurance cost.

- Find discounts: Insurers offering a wide range of discounts, including discounts for skillful students, for having multiple policies and for expert driving tracked by an app.

- Raise your deductible: There is risk inherent in this approach because it means more than out-of-pocket expenses if you are at fault in another accident. However, a higher deductible volition lower your premium.

- Reduce your coverage: Although not an ideal choice, getting less coverage is a manner to reduce your rates. Yous will withal need to accept the minimum coverage required in your state.

- Meliorate your credit score: Most states gene in credit scores for insurance costs. Paying off debt, non missing payments and addressing any bug on your credit report tin all help lower rates.

- Shop around: When in doubt, at that place's ever value in seeing who is offering the best rates for y'all. Different insurers might treat your situation differently, so comparing quotes is e'er a good idea.

Frequently asked questions

How much does insurance go upwards later on an accident?

Machine insurance premiums increase an average of 46% after an accident with a bodily injury claim, according to an analysis of national rate data. Accidents with extensive holding damage — $2,000 or more — tin can raise rates even more than than that.

Tin can you get car insurance after an blow?

In the vast majority of cases, yes, yous can become car insurance after an accident. If you have multiple at-fault accidents and other incidents and are having problem finding a company to cover you lot, you might demand to compare non-standard companies like The General and Direct Auto. Expect to pay higher insurance rates either way.

Will my insurance go up if I file a claim?

Yep, but how much insurance rates become up after a claim varies based on your driving record and the severity of the accident. If your claim is close to your deductible, information technology commonly makes sense to pay for repairs out of pocket to avoid whatever potential increases in rates. Some policies require yous to written report any accidents to your insurer.

How long does an accident affect your insurance?

Insurers most often focus on the past three years of your driving tape when setting rates. An blow usually affects rates for at least that long, though some insurers factor in an at-mistake accident for upward to five years or longer in rare cases.

Do insurance rates go up after a no-fault accident?

In about situations, your rate volition not become up after an blow in which y'all are not at fault. All the same, some companies may enhance your rates even if you lot're not the at-fault party.

Methodology

Rates for accidents with actual injuries were based on rates gathered from every country. Rates for accidents with property harm were based on drivers in Pennsylvania, Massachusetts, Texas and Alabama. A 30-year-onetime human being with a 2015 Honda Civic with coverage limits of:

| Coverage type | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist actual injury | $l,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used Quadrant Information Services to compile the analysis and insurance rate data. The data is publicly sourced from insurer filings. Rates should be used for comparative purposes only, as your quote may be different.

Will My Insurance Go Up If I Use My Insurance To Fix My Car Instead Of The Other,

Source: https://www.valuepenguin.com/how-does-accident-affect-my-car-insurance-rates

Posted by: sanchezyournegand.blogspot.com

0 Response to "Will My Insurance Go Up If I Use My Insurance To Fix My Car Instead Of The Other"

Post a Comment